100% Tariff Hammer Blow!

- Author:Demi

- Source:Sunny Glassware

- Release Date:2025-10-20

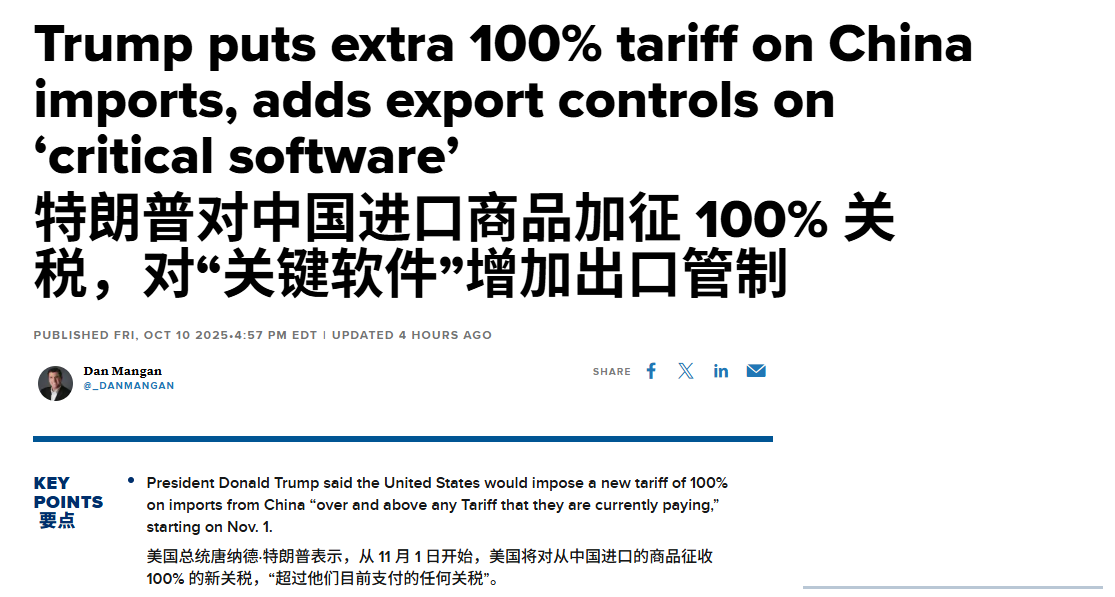

On October 10 US time, the declaration posted by Trump on a social platform – "imposing 100% additional tariffs on all Chinese goods imported to the US starting November 1st" – poured ice water on the scented candle jar industry, which was in its peak season sprint for Christmas. As the supply chain core for 80% of US fragrance brands, Chinese candle jar manufacturers suddenly face the dire situation of doubled costs, turning the cross-border peak season instantly into a "survival test."

Tariff "Nuclear Bomb": Cost Inversion, Immediate Order Loss

"One container of embossed candle jars originally cost $28,000; now the tariff alone would be $28,000, meaning we're essentially giving them away for free and even paying freight on top!" calculated Sunny Glassware, a veteran with 15 years in the US market. Factoring in the existing 15% base tariff rate, the actual tax burden reaches 115%, a nearly fivefold surge compared to the previous 25% punitive tariffs.

Simultaneously upgraded compliance thresholds add insult to injury. US Customs increased the lead and cadmium testing items for glass candle jars from 3 to 8, skyrocketing the testing cost per batch to $5,000 and extending customs clearance cycles to 21 days. Some orders that can't make it for Christmas replenishment have already been canceled outright.

Market Shift: From "Sole Focus on the US" to "Eastern Breakthrough"

The tariff storm is forcing the industry to accelerate "de-Americanization." Data shows leading companies have already reduced their US market share from 65% to 30%, betting instead on emerging markets:

-

ASEAN Battlefield: Utilizing RCEP Certificates of Origin, candle jar exports to Thailand enjoy a 4% tariff reduction. Orders for lotus-patterned jars incorporating Buddhist elements surged threefold within three days.

-

Middle East Track: Luxury candle jars hand-inlaid with gems command a premium rate of 50%. A high-end mall in Dubai placed a one-time additional custom order for 2,000 units.

-

European Substitution: Low-carbon candle jars with carbon footprint certification are opening up the German market with a "green premium," achieving a 42% year-on-year order increase in October.

"US clients demand we bear 50% of the tariff, while Middle Eastern clients proactively offer higher prices to secure goods," said Sunny Glassware, which has already shifted production lines towards larger jars suited for emerging markets, adding six non-US clients within 10 days.

Facing this survival test, Sunny Glassware has launched multi-dimensional self-rescue efforts. As highlighted by the plight of US small business owner Matthew Hassert, the US domestic market simply cannot find glass candle jar factories matching Chinese craftsmanship. Research from Harvard University has long confirmed that 100% tariffs ultimately get fully passed on to US consumers, leading to a sharp 95% price increase for imported goods and further fueling inflation. This tariff war has no winners, but Chinese candle jar enterprises are restructuring their global competitiveness amidst the upheaval.